What We Do

We tailor our services to the unique needs of each client and direct our team’s focus to help you overcome the challenges in your business.

We provide capital and business advisory services to small and medium sized companies. We bring value to our clients with our access to capital markets and network across multiple industries. .

About Us

We tailor our services to the unique needs of each client and direct our team’s focus to help you overcome the challenges in your business.

We understand the need for an objective perspective and work alongside your company to achieve your goals.

Our network and relationships across multiple industries provides additional value to our clients.

Objective advice that is free from structural conflicts of interest

Guidance centered around solving your unique situation and needs

Attention and determination to your most complex challenges

Focus on our own usefulness and building long-term value

Focus on the practical steps and requirements to turn good ideas into a reality

We nurture, encourage, empower, and train to provide lasting results

We take care of our clients and their employees as if they were our own

We appreciate what you’ve built and help to carry the momentum

Capital Advisory

Our Capital Advisory team helps our clients to remain focused on operating their business while we develop strategic financing solutions to provide financial strength and support your company’s goals

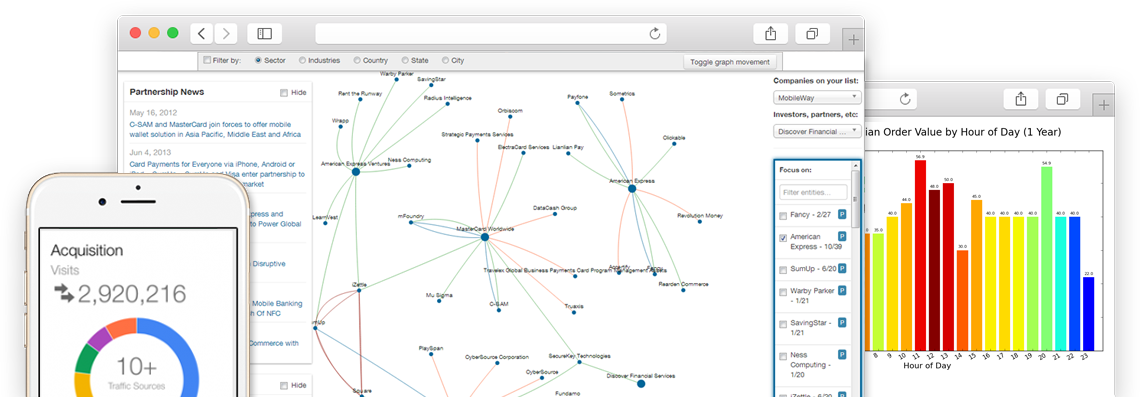

Business Advisory

Our Business Advisory Team and partnership network allows us to customize relevant solutions to support your business in a variety areas.

H & M Advisory adds value to your board of directors by... LEARN MORE

The dynamics of any business change with time. As time passes... LEARN MORE

Effective strategy, team members, and execution are vital to... LEARN MORE

We understand the value of people and their importance to... LEARN MORE

The appropriate technology solutions and infrastructure are... LEARN MORE

Accounting and financial management add significant value to... LEARN MORE

Mr. Hess’s work with Urban Ithaca Real Estate has been instrumental in our expansion. His experience, intellect and work ethic has helped us deliver successful outcomes over the short and long term.

H&M played an integral part with our financing needs and helped us to understand the value of licensing and sub-licensing our technology.

Meet our People

Terry is the Founder and Managing Partner of H & M Advisory (SSP). Prior to SSP, Mr. Hess was CEO of Laurus Technical Institute where he built a scalable education platform to fulfill market demand for education and employment opportunities. Terry built a management team and increased revenues from $1.8 million to over $8.0 million, and raised over $5.7 million in debt and equity. Mr. Hess began his career in New York City working as a European institutional equity salesman with WestLB’s U.S. investment banking division. Afterward, he joined Sonnenblick-Goldman, a real-estate investment bank, where he managed and assisted with over 20 projects and closed over $1.1 billion in financing and equity transactions. Terry holds a BS degree in Finance from Cornell University School of Hotel Administration.

Justin is an entrepreneur, management consultant and a catalyst for great ideas. He has helped grow businesses in a variety of industries including real estate, legal services, hospitality, and retail. His passion for feeding the entrepreneurial spirit in others and solving real-world business issues led him to leave big-firm consulting and found an independent management consulting firm in 2011 focused on building smarter, more productive small law firms. Justin graduated with an MBA from Vanderbilt University with a dual concentration in Strategy and Human/Organizational Performance. He also graduated as a member of Beta Gamma Sigma (international business school honors).